Navigation

Contact Information

Toronto – 320 Front St W Suite 1600, M5V 3B6

Halifax – 2570 Agricola St, B3K 4C6

Email: info@timespacemedia.com

Phone: 902-429-8463

Subscribe to our insights newsletter

Whether it’s your gas, your grocery bill, or a meal at your favourite restaurant, prices are going up.

And as consumers take a hard look at their expenses, they are looking to cut back where they can. As an advertiser, you can’t sit back and hope you aren’t included in that list, you must take action in understanding how you can delight the changing consumer.

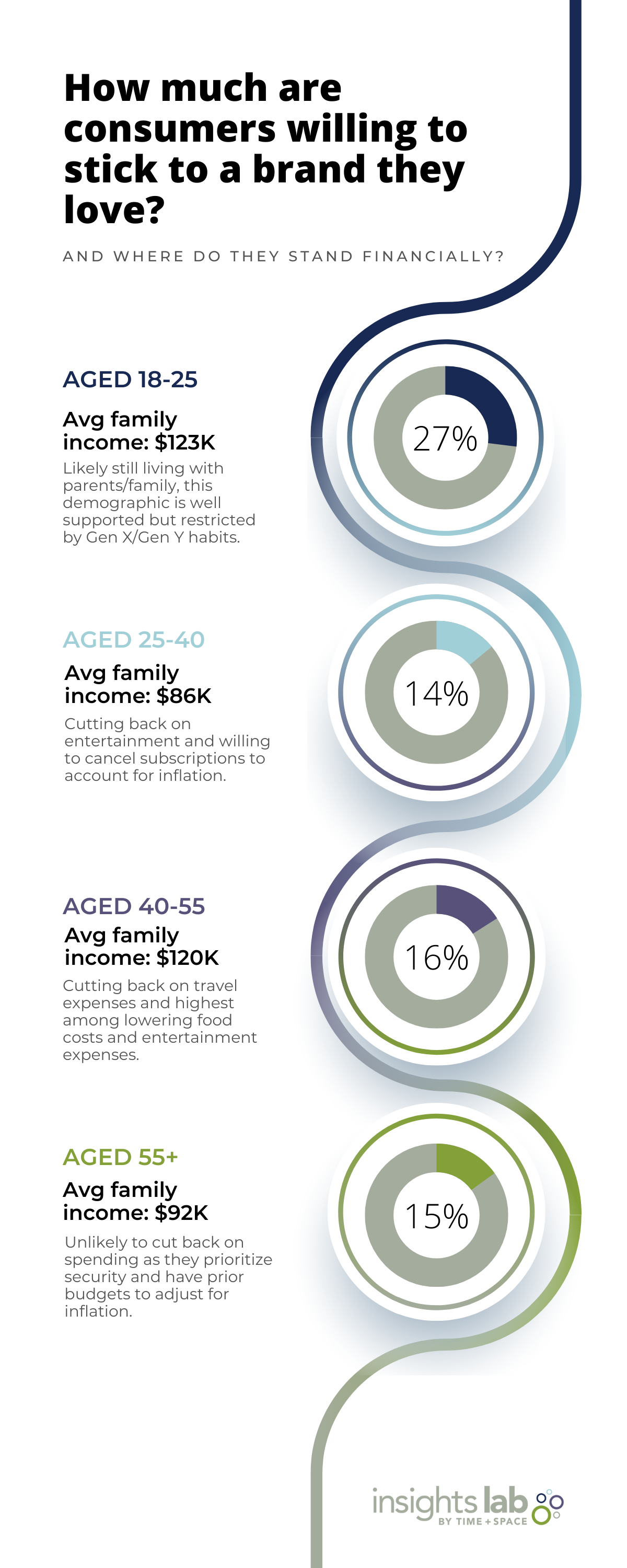

According to Ipsos Rieds Inflation Tracker, which seeks to understand the behavioural changes of consumers as prices rise, different generations react very differently to inflation. While Gen X (aged ~40-55) are cutting back the most, members of Gen Z (aged ~10-25) were the ones most likely to create budgets for themselves. 25% of Gen X are cutting back on entertainment and 30% on travel expenses. While many of the younger generations struggle to cut back and stick to their budgets, 50% of the Baby Boomer Generation (aged ~55-75) are doing nothing to change their spending habits.

Overall, we see that “medium-income earners are downshifting their spending most. They are dialing back dining and ordering-in expenses (28%, versus 19% for low income and 25% for high income), purchases of electronics (18%, versus 10% low income and 9% for high income) and alcohol consumption (17%, versus 15% for low income and 9% for high income)”. Middle-income earners are likely cutting back more than low-income as they previously had the option to make frivolous purchases, whereas low-income have always had to stick to a strict budget.

But where does any of that leave advertisers?

There is a chance for advertisers to increase their voice in the market to speak to consumers and meet their needs. First, advertisers should understand the changes being made by their targeted demographic groups – what they are cutting back on – and then produce solutions for those specific groups.

We can see that Gen Z is more likely to stick to the brands they love (27%); they are not restricted in the same way as some of the older generations and put their money behind those companies that have delighted them. Of the rest of the generations, only 15% will remain loyal to the brands they love but are still willing to cut back if necessary.

This is where you, as advertisers, need to come up with solutions either to demonstrate the necessity for your products or to position them as being of high enough value to offset changing behaviours.

If your target audience skews younger you are likely hitting Gen Z and Gen Y, who may be more brand loyal but are still looking to keep on budget and cut down on any unnecessary purchases. According to Insights Lab, 28% of the 18-40 segment are preparing grocery lists beforehand, therefore companies with products in grocery stores hoping to reach this grouping need to make an impact prior to the in-store experience.

Dialing up spend on digital for this group will put your product top-of-mind as they create their budgets and lists.

When it comes to finding entertainment, younger generations are clever in finding ways to save. Whether it’s streaming service accounts or travel, Gen Z and Gen Y are sharing the financial burden with others. “A third of Gen Z adults said they traveled less by car to save money, compared with 47% of millennials who said the same. Gen Z adults are also the most likely to say they sought out a cheaper way to ensure they could still enjoy car travel, such as carpooling to share costs.”

Those hoping to capture the attention of these groups will need to lean into this habit, when available, offering options for group rates or discounts for those who refer a friend to their product or service.

Another winning strategy with these groups is to develop family plans. Gen Y and Gen X are those who are more likely to have children or dependents in their home and are looking for ways to spread a product or service across all members of their household.

22% of those 30-55 will stock up if they see a product or brand that they like is on sale. Those advertisers hoping to target this group should maximize their bulk offerings to show value to this segment. Since they are the group that is cutting back the most across the board, advertisers should also up their ad spend to these groups when deals are happening to permeate the market and grab attention.

Companies like Unilever are seeing the value in this as they boost marketing to build customer relationships and show them other options that don’t mean switching to private label.

Lastly, if your product is in no way a necessity and that one of your targets is the 55+ grouping, knowing they are not curbing spending, taking some ad spend away from other targeted groups and reallocating to the 55+ group may help offset revenue lost with younger generational groups. Continuing to show value and delight your 55+ targets will create impacts on all segments.

Toronto – 320 Front St W Suite 1600, M5V 3B6

Halifax – 2570 Agricola St, B3K 4C6

Email: info@timespacemedia.com

Phone: 902-429-8463

Subscribe to our insights newsletter