Navigation

Contact Information

Toronto – 320 Front St W Suite 1600, M5V 3B6

Halifax – 2570 Agricola St, B3K 4C6

Email: info@timespacemedia.com

Phone: 902-429-8463

Subscribe to our insights newsletter

It’s one of the questions we’ve all gotten in the last two years, isn’t it? “Where would you travel if you could right now?” Or maybe you’re the one asking and gathering ideas. Everyone has been dreaming about where they will go, whether for business or pleasure, when they could travel again. And with vaccines distributed and restrictions beginning to lift in the summer of 2021, many began to put their plans into action and start asking the question to themselves, “where will I go?”

And though complications continue to arise with travel restrictions and the rise of new variants, there remains optimism for the tourism industry. Alongside restrictions and changing sentiments, tourism advertisers must understand who is willing to travel, where they are travelling, and what they are looking for in their travel experiences.

Our possible travellers have been split up by age to demonstrate the different paths each group will take as they begin to plan their next travel experience.

When the world shut down in March of 2020, tourism was one of the industries that took the largest hit. Not a day went by without hearing about how affected the world was by the loss of tourism. Many areas are run through the funds they receive during tourism seasons.

One case study is to look at Banff, a mountain resort town, as they were forced to lay off as many as 4,000 workers in the weeks after the first wave shutdown. The Banff Mayor remarked, “These are dire circumstances, we are in a very serious situation.” And an area like Niagra which is estimated to have lost $4 billion in GDP since the onset of the pandemic. Overall, “Canada’s tourism sector saw a 53 per cent decline in GDP during the first year of the pandemic, according to data from the World Travel and Tourism Council.” The impact of the pandemic on the industry has been severe and both those in the industry and those who wish to travel have been anticipating the lifting restrictions.

With the openings of many countries borders in the summer of 2021 thanks to vaccine rollouts, tourism began to see a light at the end of the tunnel. It has been a slow progression since then to many as they begin to plan travel both within and outside of their home countries. Those in Canada have focused primarily on advertising to neighbouring provinces. But as we continue to see travel return to a sort of normalcy, who will feel comfortable travelling? And when they do, how are they booking, and where are they going? Through the Google Trends travel demand graph above, it’s clear the desire to travel is in full force. The first step for advertisers as they look to target this demand will be in understanding their audience.

Destination Canada has outlined that the strategy for recovery in this sector will focus on three pillars: Leisure Domestic travel, Leisure International travel, and Business International travel.

Leisure Domestic travel will focus on encouraging Canadians to continue exploring their own provinces with the eventual goal of broadening to feel comfortable exploring across the provinces. Leisure International travel will inspire those outside our borders to visit Canada by displaying the vibrancy of our cities and cultures. And lastly, Business International travel will hope to keep Canada top of mind for business events being held in the coming years, drawing both domestic and international travellers.

These goals will help boost the industry in the coming years, and as we consider who is travelling, we can understand how they fit into one of these three strategies.

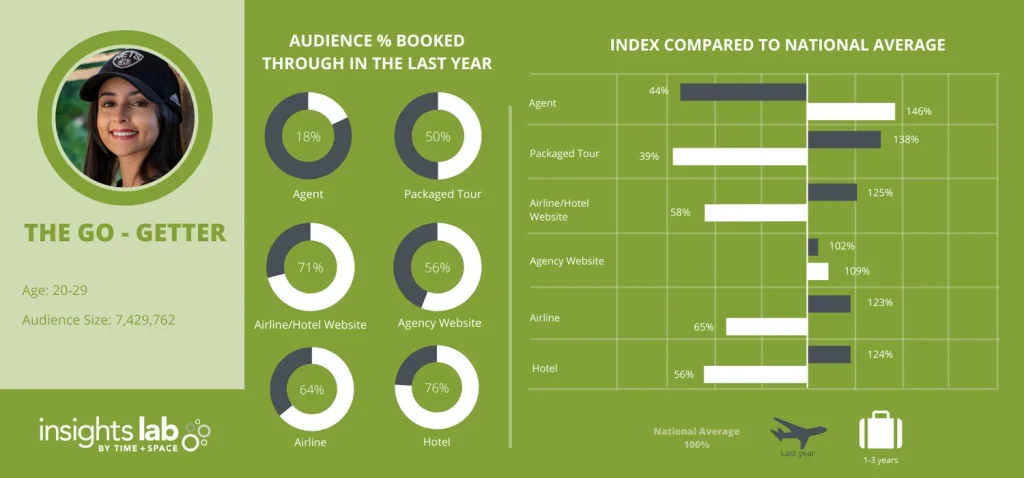

Young people are one of the demographics that the tourism industry should be watching closely. Most polled that on their last vacation they spent either less than $500 or more than $4000. For the 52% that spent less than $500, this would indicate that they either booked a “staycation” somewhere close; perhaps they booked an Airbnb or stayed with a close contact and created a budget experience close to home. Those that spent over $4000 are those that had saved up money and energy from lockdowns and took to larger, more extravagant experiences to fill their desire to travel, perhaps something they had saved up for or had planned to do at a milestone like the end of college or university. In an article published by ABC News in Australia, one college student describes her initial disappointment that her plans for a pivotal backpack trip around Europe had to be put on hold but soon found contentment after turning to her local scenery and exploring deeper into her own country. This is a narrative we hear echoing across the world as this demographic explores around them, soaking up new experiences closer to home.

This demographic greatly over indexing against the national average for the lowest and highest amounts available in the survey indicates a “go big or go home” mentality. We see this continuing in 2022 as many young people feel safer to travel they will take one extravagant vacation to satiate their pent-up wanderlust. The under $500 vacations will continue for this group as well during times where restrictions may tighten and in-between larger trips. Both advertisers for international travel as well as domestic will find this an eager demographic in the coming years. Advertisers should closely watch this group as they fall into several of the groups outlined by Destination Canada. Younger Canadians will be a big part of the Leisure Domestic Travel group, and both those who live in Canada and those who don’t will be looking for one large Leisure International Travel experience as well.

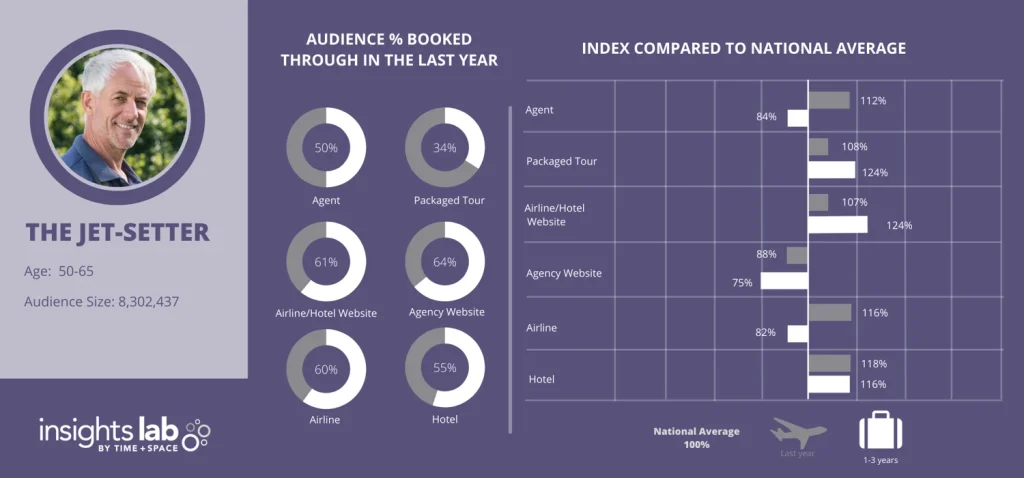

Another demographic to watch is the 50-65 group, who are taking more medium-level trips. Perhaps an all-inclusive resort, tour, or trip across the country to see a family member, this group is spending $1000-$3000 on their getaways.

This will be the group that travels the most as things begin to reopen safely. Unlike the 20-29 age group, the Jet-Setter has the money to take multiple trips during the year and is looking to experience new places at higher quality. This is the group that will book a hotel over an Airbnb, make reservations at local high-end restaurants, and book local tours.

While the Go-Getter will have multiple small trips and one large trip, the Jet-Setter will continue to take regular, medium trips, making them altogether more attractive to tourism advertisers year-round. This group is also likely to drive the return of business travel, “Delta reported domestic passenger volume approaching 60 percent of 2019 levels during the fourth quarter of 2021” and expects Spring/Summer 2022 will see a return to normal levels of business travel. Not only will this group be the most travelled for pleasure but for business as well, giving advertisers ample opportunity to grab the attention of this segment. Again, this group will fall under multiple sections of Destination Canada’s recovery plan taking a more well-rounded approach to their travel experiences.

Our other two travellers are more cautious, whether with money or time. While they are still primed to be a part of travel in the coming few years, the Busy Bee and the Explorer are more difficult to attract.

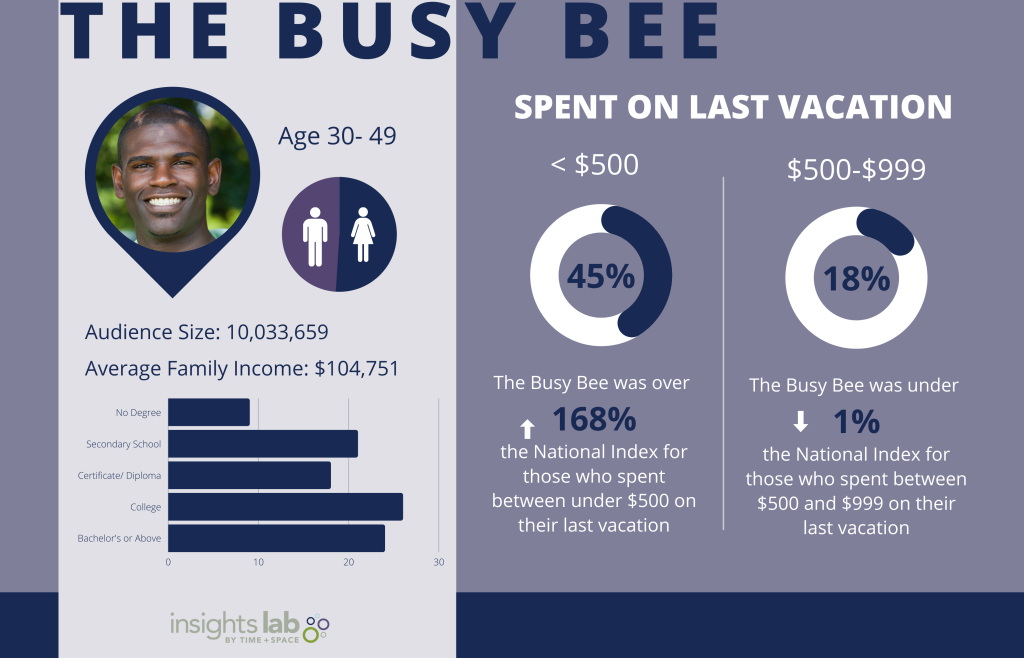

The largest age category is the Busy Bee, and though this group is still travelling, their chaotic schedules are keeping them from booking longer, more expensive getaways. This age group is more likely to kids or an elderly parent in the home, more likely to be at a pivotal part of growing their careers, and overall less likely to have extra income and time for travel.

Much like the Go-Getter, the Busy Bee over indexes on vacations under $500, taking their children to a family members home the next province over, or having a small romantic getaway for a night or two at the local spa. Unlike their younger counterparts, this is the only spending category they over-index on, their next most spent category (between $500 and $999) still indexes much lower than all of the other groups, closer to the national average. The Busy Bee will be another large part of Destination Canada’s plan for increased domestic leisure travel.

However, because this group has polled low in “spend on last vacation”, it could indicate a spike coming in one large family vacation when they feels comfortable to do so. One respondent in a New York Times article last year said, “I do a lot of family travel but it’s usually just a family of four or five. Now I’m getting two adult kids and their families and grandparents, and sometimes both sets of grandparents. And everyone is spending more money because nobody ate out or traveled in 2020, so they have funds left over.”

To grab the attention of this demographic, advertisers will need to understand that a lack of time remains a barrier for the Busy Bee, even as restrictions lift. And because of the increased likelihood of children or elderly parents present in their care, they will be more cautious than any other group as well. This could mean creative that focuses on one large family reunion event or getaway that displays a relief of stressors to capture their attention if they have saved up money over the last two years for a larger vacation.

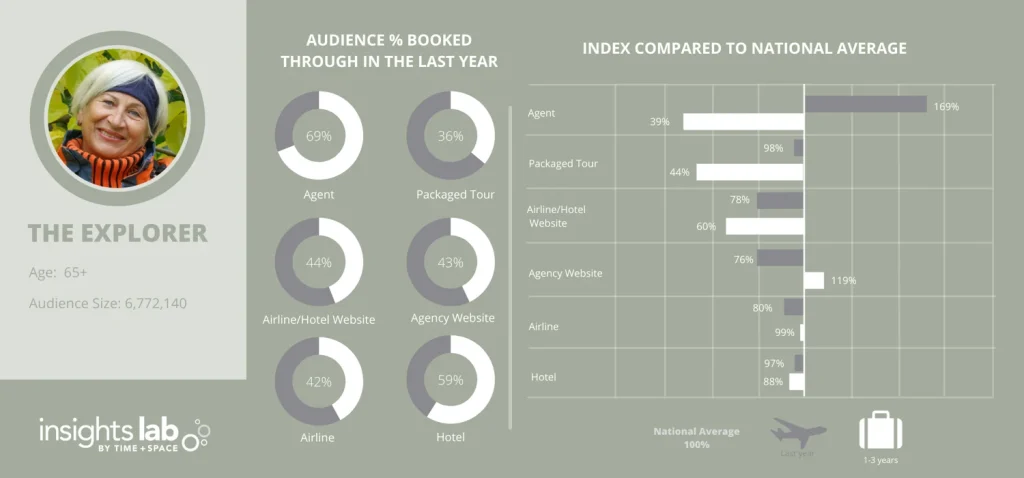

Our last demographic is the 65+ crowd, willing to travel but more cautious than many other age groups due to both safety and finances. This is the group that is most likely to be on a pension or restricted budget, so while they have the time that the Busy Bee group does not, they must make their one or two vacations a year count.

We found that the Explorer over-indexed on vacations $500-999 as well as on vacations $2000 or greater. This data when compared with our insights on the average income and travel habits can conclude that they are creating experiences much like the Jet-Setter, spending their money on travel that will delight them as well as keep them safe. However, unlike the Jet-Setter, they are travelling less frequently and are more cautious as to how they spend their money.

This is a group that will be much more open to travel advertising than the Busy Bee, but when booking, much more cautious of the experience than the Go-Getter or the Jet-Setter. Packages, cruises, and advertising that focuses on getting out safely will be help get this group back into a regular habit of travelling. Both those in this age category who live in Canada and those who do not will help fuel the plan for increased leisure international travel as Canadian travellers will be ready to take further trips, and those outside Canada may choose the country because of our rich culture paired with our reassurance of safety.

So, who is the modern traveller? As we’ve looked at, all age demographics have been looking forward to the return of travel in their lives. While the modern traveller could be anyone, marketers must understand the types of trips that each demographic is taking, what they hope to get out of their trip, and where best to address them.

Stats Canada reported that, “Compared with December 2020, more than 10 times as many non-resident travellers arrived from abroad at Canadian airports equipped with electronic kiosks during December 2021. This was less than two-thirds of the number for December 2019, prior to the pandemic.” While we are starting to see more movement in Canadian airports, there is still a necessity for hyper-precision in tourism advertising to target those who not only feel comfortable to travel, but are more likely to be planning and booking something in the next few months.

And once you understand your demographics, you must begin to understand how to reach them in the places they are comfortable with. If you wish to target the Go-Getter as they plan their backpacking trip, or the Busy Bee as they plan their family road trip, understanding how they are booking and where they are going is the next step in creating advertisements that make your audience feel safe, understood, and ready to take the leap back into travel.