Navigation

Contact Information

Toronto – 320 Front St W Suite 1600, M5V 3B6

Halifax – 2570 Agricola St, B3K 4C6

Email: info@timespacemedia.com

Phone: 902-429-8463

Subscribe to our insights newsletter

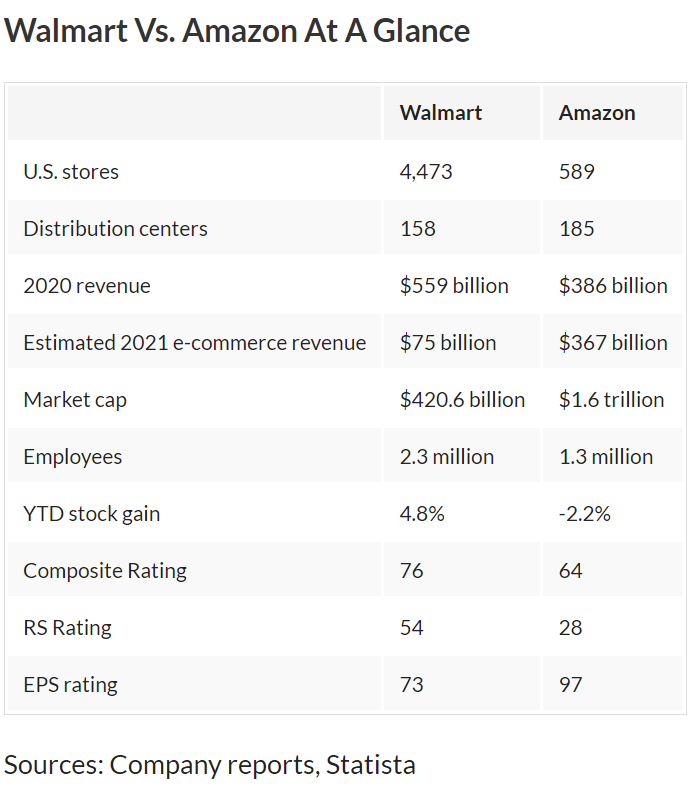

There’s no question that the retail and ecommerce industries have put their foot on the gas regarding digital innovation over the last two years. And there are no cars speeding down the proverbial highway quite like Walmart and Amazon.

As we blend large retail storefronts with online offerings, the fight for consumer attention grows even more prevalent. Not only does one company now need to win in their own traditional space, but outside their area of expertise.

What’s fascinating for those who are sitting back to watch the fight is how these goliaths are taking on new innovation as they move into their competitors space. Amazon has needed to revolutionize in-person retail, and Walmart the same for its online offerings.

For those brands that aren’t working with Amazon’s revenue of $116.444 billion (Q1 2022) or Walmart’s $141.57 billion (Q1 2022), there is much still to be gained in keeping up with their movements.

Let’s first look at Amazon.

In 2020, Amazon accelerated its plans for Amazon Fresh, their physical grocery chain that featured new innovations for the CPG industry including grocery carts that doubled as check-outs and Amazon Alexas in the aisles to help you find products. This was an extension of their Amazon Go efforts, which were smaller convenience store locations that began opening in 2018 that innovated by allowing consumers to take items and leave without passing through a checkout at all.

This May, we saw the opening of Amazon’s next foray into physical stores, this time in the fashion retail space, with the launch of its first Amazon Style store. They’ve altered traditional shopping by only providing one size of each piece on the sales floor and utilizing their app to scan items to buy outright or try on in the fitting rooms.

Through each of Amazon’s ventures into in-person shopping, whether the CPG or retail space, it blends its current technology into the experience.

Now, if we look at Walmart, they are starting with an unmatched grasp on the retail market and looking to keep up on their ecommerce integration.

In the last two weeks alone, Walmart has launched two new initiatives that blend its retail offerings with new technology. It has partnered with Instacart to create a virtual convenience store, bringing their products to consumers faster and putting them top of mind for those who already use the Instacart app for delivery.

In their own app, they have integrated augmented reality (AR) that allows users to see how Walmart’s products, mainly home furnishings, will look in their space.

And as the money and manpower behind these giants allows them to test new ways of integrating tech and retail, those who keep up with these movements will benefit as well.

When we look at some of the new innovations that have come out of this industry crossover, we can see that there are elements that work well, and some that don’t. Amazon Fresh can teach us more about what consumers really want for innovation in stores, and what they aren’t willing to compromise on: “Dunnhumby cited speed (easy in and out, fast checkout) and digital (easy shopping online or with an app, useful information) as Amazon Fresh’s chief competitive advantages, and operations (e.g. out-of-stocks, price consistency, right products, clean stores) as its main disadvantage.”

And Walmart’s app has shown that using technology to add to an already existing excellent operations system can create great success. The app sees about 120 million users a month and those using it spend approximately 40% more than those who don’t use it.

Whether your company works in retail, ecommerce, or CPG, the feud between Walmart and Amazon shows us that shoppers want convenience and pricing first and innovative technology second. If you are working toward digital transformation, keep in mind that consumers want the tech you integrate to create convenience across the board.

Toronto – 320 Front St W Suite 1600, M5V 3B6

Halifax – 2570 Agricola St, B3K 4C6

Email: info@timespacemedia.com

Phone: 902-429-8463

Subscribe to our insights newsletter