Navigation

Contact Information

2570 Agricola St, Halifax, NS, B3K 4C6

Email: info@timespacemedia.com

Phone: 902-429-8463

Subscribe to our insights newsletter

Marketing trends are dynamic and can evolve rapidly due to changes in technology, consumer behavior, societal influences, and industry innovations. Keeping abreast of these trends is crucial for marketers to stay relevant and effective in their efforts.

Some examples of marketing trends could include the rise of influencer marketing, the increasing emphasis on personalized and data-driven approaches, the adoption of new technologies like augmented reality in advertising, or the growing importance of sustainability and social responsibility in brand messaging. Essentially, marketing trends reflect the ever-changing landscape of how businesses promote their products or services in response to shifts in consumer preferences and the broader business environment.

And this is exceptionally true in industries like Consumer Packaged Goods (CPG), where trends are as ephemeral as they are influential, staying ahead isn’t just a strategy; it’s a necessity for success. As consumer preferences undergo rapid evolution, the transformative power of data analytics becomes imperative for brands navigating the dynamic market landscape.

Traditionally, trend analysis relied on intuition and historical data, but the landscape is undergoing a seismic shift with the integration of data-driven approaches. Predictive analytics and correlational analysis emerge in this narrative, not merely enhancing but revolutionizing trend predictions. “By using data to inform their marketing decisions, businesses can create more effective campaigns, improve customer acquisition and retention, and optimize product development and user experience.”

For example, according to Forrester, devoted customers spend 109% more per year than shoppers who aren’t as devoted to your brand. Predictive analytics can help your team better target these individuals and deliver more personalized experiences.

Another important role of data in trend analysis is to help remove as much bias as possible from the situation. When approaching any campaign, advertising bias can be a hinderance but data on your target audience is a concrete way of looking past preconceived ideas and understanding the consumer where they are today, and where they could be tomorrow.

To understand the importance of data-driven insights, one must first grasp the present state of the CPG market, a landscape shaped by inflation, sustainability imperatives, and the ascension of retail media. When it comes to the current landscape, price, product quality, and convenience are the 3 most influential factors in CPG decision making. If you then look for hints in sales data, category spending, and price elasticity you can work out long-term patterns that might affect marketing plans.

When we look at the upcoming year with price, quality, and convenience as our targets for consumers, we can start parsing out trends by specifically looking at data in those areas.

For example, we know that that 2022 saw an increase in the turn to private label goods as Numerator reported in January 2023 that perceived quality of private label was on the rise as 45% of Canadians believed private label brands provided better quality than national brands. This continues as they predicted Q4 of 2023 would see a 19.6% YOY increase for private label brands. And with inflation not likely to give way anytime soon, this trend will likely continue. Therefore, by using historical data and the state of the economy as points of contact, we can predict that the trend is likely to continue.

A good example of a trend disruptor would be more data from Numerator that shows younger Canadians and new Canadians perceive private label as “poor” and “average”. And seeing data like this may be tempting to shift the overall trend, but considering the buying power of young people is low, they are unlikely to tip the scales and new Canadians may not have had the contact with private label brands they would have had with larger National or International ones, those perceptions could change over time. Once again, we would have to conclude that overall trend data won’t be affected by this data and instead, we will continue to see private label rise – though maybe not quite as much as it has in the last year.

We can also see this with retail media evolution in the Canadian market.

Retail Media in Canada has been undergoing a rapid transformation, especially in the sector dominated by giants like Walmart, Costco, Sobeys, and Loblaw. This change has been accelerated over the past year as the initial product offerings, which were met with mixed reviews from marketers, have been fine-tuned, resulting in renewed interest in the media plans for ’24 and beyond.

Retailers in Canada have adapted by enhancing their media offerings. These include leveraging loyalty programs, in-store marketing technologies, and sophisticated data analytics to understand and engage consumers more effectively, with enhancements to the offerings for many retailers improving how brands/marketers both access and activate this data.

For example, Walmart Canada, known for its extensive consumer base, has been implementing advanced data analytics to optimize its retail media offerings. Further leveraging their 1st party data while also incorporating learnings from the US market to enhance the domestic offerings in Canada. Ultimately, the personalized shopping, and ad experiences are improving on the back of these efforts, both online and offline, which are designed to resonate with the evolving preferences of Canadian consumers.

Costco, Sobeys, and Loblaw have not been far behind in this race. Each has refined its unique approaches to retail media, utilizing its vast stores of consumer data to create targeted marketing offerings that are now beginning to deliver the ROI promises they once established.

This shift towards customized and consent-based marketing is not entirely new. However, it has matured significantly in recent years, driven by the need for more privacy-centric approaches that consumers are demanding but balancing the targeting that marketers and CPG brands expect.

Retail media in Canada, exemplified by the strategies of Walmart, Costco, Sobeys, and Loblaw, has certainly aged in reverse. These strategies, while not new, have gained renewed importance and effectiveness in the current era, offering valuable lessons for marketers aiming to navigate the complexities of consumer engagement in a privacy-conscious world. For this reason, we anticipate a material growth in adoption in ’24 and beyond.

This kind of data work can be done from any emerging, current, or not yet documented trend. Analyzing not just what consumers say they want, but how they are interacting with the world around them, all gives clues to where they might turn next.

From in-depth customer surveys and granular geolocation shopping behavior to the goldmine of information hidden in loyalty cards and the ever-expanding universe of e-commerce apps, each piece contributes to a comprehensive understanding of consumer behavior.

Gathered through many different methods, retail media’s explosive performance in the market helps marketers capture data from loyalty programs and kiosk usage to geolocation shopping behaviour. For example, our partners at Stingray work with retailers to connect with consumers at the point of sale through store audio. According to Mastercard, “Retail media networks generate incremental advertising revenue for the retailer by addressing a critical need for consumer goods companies – consumer reach.” And when it comes to brand impact, 96% of surveyed individuals for Skai confirmed that their retail media programs achieved desired brand impact last year (2022), with only 4% reporting little to no effect on objectives. In addition, 54% met, and 9% exceeded, their goal KPI expectations for the year.”

Data-driven trend insights aren’t just numbers on a spreadsheet; they are the architects shaping brand strategies. Companies are aligning product development, marketing campaigns, and overall brand positioning to achieve their goals.

As a case study in the world of CPG, Eggo’s success story stands out as a testament to the transformative power of trend data. Facing a challenge of neutral social conversations, Eggo strategically tapped into the morning chaos of parents with the “L’Eggo with Eggo” campaign.

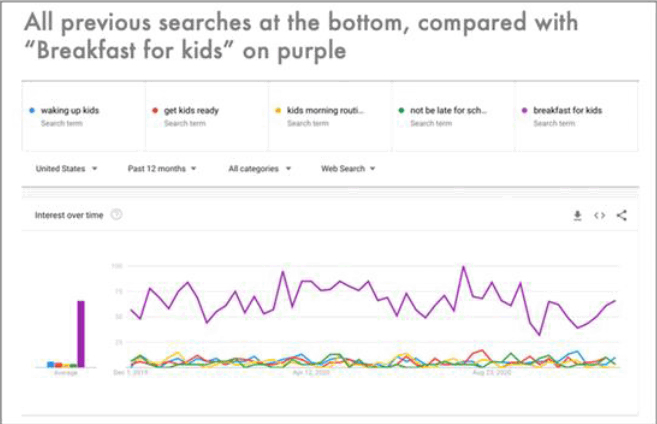

Key to their success was the innovative L’Eggometer—a data-led barometer fueled by Google and Twitter data. This dynamic duo provided real-time insights into parents’ morning stress, enabling Eggo to tailor content, tips, and even free waffles to alleviate pressure on high-stress weeks.

The results were remarkable—positive sentiment soared from 14.7% to 40.5%, surpassing their 50% goal. Instagram followers jumped by 146%, and social video performance outpaced benchmarks. Eggo’s agility in responding to trends showcased the impact of informed decision-making, especially with their algorithm combining GIndex and TIndex, favoring the real-time nature of Twitter data.

The case study not only highlights the successful use of trend data but also underscores the importance of a strategic and automated approach. For CPG campaigns, Eggo’s journey exemplifies how staying ahead of trends can fuel not just positive sentiment but also deep emotional connections with consumers.

Navigating the ever-evolving landscape of CPG requires a keen understanding of marketing trends and the transformative role of data analytics. The integration of data-driven approaches, such as predictive analytics and correlational analysis, is revolutionizing trend predictions in the CPG industry. The impact of data on trend analysis goes beyond intuition, providing concrete insights to inform marketing decisions and create more effective campaigns.

Understanding the current market landscape is essential, especially in a realm shaped by factors like inflation, sustainability imperatives, and the ascent of retail media. Analyzing emerging trends requires a deep dive into data sources within the CPG industry. In the end, data-driven trend insights are not just numbers; they shape brand strategies with precision and give you a better chance of delighting your audience.

2570 Agricola St, Halifax, NS, B3K 4C6

Email: info@timespacemedia.com

Phone: 902-429-8463

Subscribe to our insights newsletter